Sign up now

Program Overview:

The natural gas market in California has been deregulated since 1991 but unfortunately most business owners and residential customers are unaware that they have any other options regarding their natural gas purchases. This regulation allows you the ability to select who you wish to purchase your natural gas from. Wholesale Power Brokers represents gas suppliers that are able to pool their customer’s usage together and get a much better rate for natural gas purchases. Since the supplier is able to buy natural gas at prices less than Southern California Gas Company , they then pass those savings on to their customers and provide a cost savings to their customers, over what Southern California Gas Company would charge them. In your case you can save up to 10%+ off your annual natural gas bill depending on your usage.

It only takes a few minutes of your time to transfer your account from being supplied by Southern California Gas Company to being supplied by our wholesale gas supplier, and there are no start up, connection, or transfer fees of any kind to pay. Additionally, you will incur no downtime and there are no additional risks involved with having a wholesale natural gas supplier. If you have an emergency or a pipeline problem you will still deal directly with PG&E and you will not be charged extra because you buy your natural gas from a wholesale supplier. However, if you have a problem with your billing or another customer service issue you can easily call your representative and be quickly taken care of because they are much more flexible and customer service oriented than Southern California Gas Company.

You will experience no downtime and there are no start up, connection, or transfer fees.

The natural gas market in California has been deregulated since 1991 but unfortunately most business owners and residential customers are unaware that they have any other options regarding their natural gas purchases. This regulation allows you the ability to select who you wish to purchase your natural gas from. Wholesale Power Brokers represents gas suppliers that are able to pool their customer’s usage together and get a much better rate for natural gas purchases. Since the supplier is able to buy natural gas at prices less than Southern California Gas Company , they then pass those savings on to their customers and provide a cost savings to their customers, over what Southern California Gas Company would charge them. In your case you can save up to 10%+ off your annual natural gas bill depending on your usage.

It only takes a few minutes of your time to transfer your account from being supplied by Southern California Gas Company to being supplied by our wholesale gas supplier, and there are no start up, connection, or transfer fees of any kind to pay. Additionally, you will incur no downtime and there are no additional risks involved with having a wholesale natural gas supplier. If you have an emergency or a pipeline problem you will still deal directly with PG&E and you will not be charged extra because you buy your natural gas from a wholesale supplier. However, if you have a problem with your billing or another customer service issue you can easily call your representative and be quickly taken care of because they are much more flexible and customer service oriented than Southern California Gas Company.

You will experience no downtime and there are no start up, connection, or transfer fees.

California Commercial and Residential Natural Gas Frequently Asked Questions:

Question: I didn’t think I had a choice of who I could buy my natural gas from. How does this work?

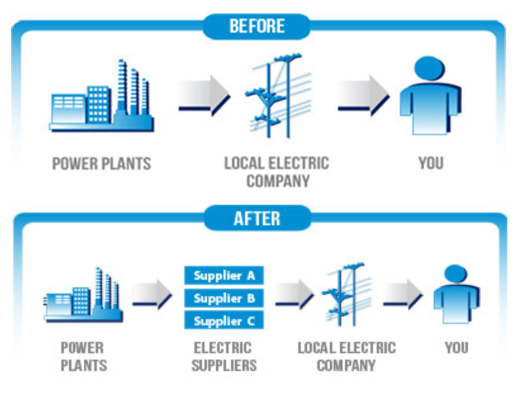

Answer: You certainly do have a choice. The natural gas industry in your area has been deregulated. The easiest way to understand it is to think of it like telecommunications deregulation, but instead of using phone lines we are using natural gas lines. Wholesale Power Brokers is able to get you signed up with a wholesale natural gas provider that will provide your natural gas at a discount and you continue to use the utilities existing pipelines to transport the natural gas to your facility or residence. There are no setup fees or connection fees and your utility will not charge you additional transportation costs. So the savings will be passed directly on to you from the actual natural gas you use.

Question: How can Wholesale Power Brokers offer me a lower rate than my utility?

Answer: The utility is allowed to build in the cost of their infrastructure, Bad Debts, and anything else the Public Utilities Commission will allow them into their actual cost of gas. The wholesale provider has minimal overhead costs, and is much more flexible and able to go out and get the best price for natural gas. The savings is then passed on to their customers.

Question: How is the wholesale natural gas provider able to get the natural gas to me?

Answer: The wholesale gas provider will give the natural gas you buy from them directly to your utility company, and then you will still pay them to transmit and distribute the natural gas through their existing pipelines to your residence or facility. So you will still be a customer of your utility, but if you get your natural gas from the wholesale provider, you will still save money annually overall when you add in their transportation charges and the savings they offer you on the natural gas.

Question: What if I have an emergency?

Answer: If you have an emergency like a gas leak or a fire you will still call you local utility company and they will come out and service your pipelines and meters, you will still be their customer because you will pay them to distribute your natural gas to your residence or facility. They will not charge you more in a maintenance or emergency situation because you have a wholesale gas supplier. However, if you have a billing or customer service issue, you can quickly contact your representative and be taken care of much quicker and effectively.

Question: What are the risks involved with switching?

Answer: There is essentially no additional risk. The wholesale gas supplier has been in business for over 18 years and has over 22,000 commercial accounts nationwide and they have never received a better business bureau complaint. That is not the case with other energy marketers. With Wholesale Power Brokers’ natural gas provider, they are truly devoted to customer satisfaction and the company was founded on the principles of Integrity, reliability, and trust. They have survived and outlasted many others in our industry even when most had only been in business a fraction of the time we have. They will be here for a long time to come and in the event they could not supply you with gas, your local utility company would begin to supply you again automatically. That is something that has never once happened in their 18 years of business.

Wholesale Power Brokers is representing a wholesale gas supplier that has been in business since 1991 and have over 10,000 accounts nationwide without ever receiving one complaint. This is because of their strong emphasis on maintaining superior customer service and customer relationships are key elements to their success.

Question: How will I be billed for the natural gas we use?

Answer: If you are a Residential Wholesale Customer you will continue to just receive your one PG&E bill. The only difference will be that instead of having PG&E’s cost for your natural gas on your bill you would have the Wholesale provider. Nothing will change from your prospective and you just pay once using any current method available to you from PG&E. There is a $.05 per day customer fee included as well.

If you are a Commercial Wholesale Customer in the PG&E area, you would be eligible to receive your charges attached to your current PG&E bill, just as outlined above. You would also have the option to receive a separate bill from the Wholesale provider for the natural gas you used. This option has no customer fee.

If you are a Commercial Wholesale Customer in the SoCal or SDG&E area you would receive a separate bill from the Wholesale provider listing your charges for the natural gas you use each month.

Question: Is there a chance that the Wholesale provider would cost me more overall than my Utility.

Answer: In some months there is a chance that it could cost you more, but that does not happen often. However, when you look at it on an annual basis they have never cost their customers more than the utility would have on a per Therm basis. The reason that the Wholesale provider’s price can sometimes be more than the utilities price is because the utility actually lags behind were the current market price is. Historically wholesale prices on a monthly level are most always less than the utilities, but when natural gas prices rise unexpectedly and quickly in a matter of a few months, it can result in the wholesale price for a month being more than the utilities. This is because when they were buying their natural gas at the markets current rates, the utility was still selling gas at rates below where the current market was. This is because they must set their monthly prices well in advance of when the Wholesale provider does and the market was not forecasted to rise so much or so quickly. This results in PG&E’s prices continuing to rise as the Wholesale providers’ prices level off or drop from their highs. That is why it is important for customers to look at the savings on an annual basis. Essentially, if their prices are less than the Wholesale provider’s in one month, then that difference is likely to be made up in subsequent months.

Answer: You certainly do have a choice. The natural gas industry in your area has been deregulated. The easiest way to understand it is to think of it like telecommunications deregulation, but instead of using phone lines we are using natural gas lines. Wholesale Power Brokers is able to get you signed up with a wholesale natural gas provider that will provide your natural gas at a discount and you continue to use the utilities existing pipelines to transport the natural gas to your facility or residence. There are no setup fees or connection fees and your utility will not charge you additional transportation costs. So the savings will be passed directly on to you from the actual natural gas you use.

Question: How can Wholesale Power Brokers offer me a lower rate than my utility?

Answer: The utility is allowed to build in the cost of their infrastructure, Bad Debts, and anything else the Public Utilities Commission will allow them into their actual cost of gas. The wholesale provider has minimal overhead costs, and is much more flexible and able to go out and get the best price for natural gas. The savings is then passed on to their customers.

Question: How is the wholesale natural gas provider able to get the natural gas to me?

Answer: The wholesale gas provider will give the natural gas you buy from them directly to your utility company, and then you will still pay them to transmit and distribute the natural gas through their existing pipelines to your residence or facility. So you will still be a customer of your utility, but if you get your natural gas from the wholesale provider, you will still save money annually overall when you add in their transportation charges and the savings they offer you on the natural gas.

Question: What if I have an emergency?

Answer: If you have an emergency like a gas leak or a fire you will still call you local utility company and they will come out and service your pipelines and meters, you will still be their customer because you will pay them to distribute your natural gas to your residence or facility. They will not charge you more in a maintenance or emergency situation because you have a wholesale gas supplier. However, if you have a billing or customer service issue, you can quickly contact your representative and be taken care of much quicker and effectively.

Question: What are the risks involved with switching?

Answer: There is essentially no additional risk. The wholesale gas supplier has been in business for over 18 years and has over 22,000 commercial accounts nationwide and they have never received a better business bureau complaint. That is not the case with other energy marketers. With Wholesale Power Brokers’ natural gas provider, they are truly devoted to customer satisfaction and the company was founded on the principles of Integrity, reliability, and trust. They have survived and outlasted many others in our industry even when most had only been in business a fraction of the time we have. They will be here for a long time to come and in the event they could not supply you with gas, your local utility company would begin to supply you again automatically. That is something that has never once happened in their 18 years of business.

Wholesale Power Brokers is representing a wholesale gas supplier that has been in business since 1991 and have over 10,000 accounts nationwide without ever receiving one complaint. This is because of their strong emphasis on maintaining superior customer service and customer relationships are key elements to their success.

Question: How will I be billed for the natural gas we use?

Answer: If you are a Residential Wholesale Customer you will continue to just receive your one PG&E bill. The only difference will be that instead of having PG&E’s cost for your natural gas on your bill you would have the Wholesale provider. Nothing will change from your prospective and you just pay once using any current method available to you from PG&E. There is a $.05 per day customer fee included as well.

If you are a Commercial Wholesale Customer in the PG&E area, you would be eligible to receive your charges attached to your current PG&E bill, just as outlined above. You would also have the option to receive a separate bill from the Wholesale provider for the natural gas you used. This option has no customer fee.

If you are a Commercial Wholesale Customer in the SoCal or SDG&E area you would receive a separate bill from the Wholesale provider listing your charges for the natural gas you use each month.

Question: Is there a chance that the Wholesale provider would cost me more overall than my Utility.

Answer: In some months there is a chance that it could cost you more, but that does not happen often. However, when you look at it on an annual basis they have never cost their customers more than the utility would have on a per Therm basis. The reason that the Wholesale provider’s price can sometimes be more than the utilities price is because the utility actually lags behind were the current market price is. Historically wholesale prices on a monthly level are most always less than the utilities, but when natural gas prices rise unexpectedly and quickly in a matter of a few months, it can result in the wholesale price for a month being more than the utilities. This is because when they were buying their natural gas at the markets current rates, the utility was still selling gas at rates below where the current market was. This is because they must set their monthly prices well in advance of when the Wholesale provider does and the market was not forecasted to rise so much or so quickly. This results in PG&E’s prices continuing to rise as the Wholesale providers’ prices level off or drop from their highs. That is why it is important for customers to look at the savings on an annual basis. Essentially, if their prices are less than the Wholesale provider’s in one month, then that difference is likely to be made up in subsequent months.

Natural Gas Industry - Southern California Gas Company

http://www.socalgas.com/for-your-business/natural-gas-services/Storage, Supplies, Prices, Technology . . .

Historically, the cost of generating power declined as utilities built ever-larger power plants, which increased efficiency and reduced production costs. Utilities routinely requested rate reductions based on declining costs as well as to increase electrical demand. Increased electric demand required more and larger plants, which reduced costs further as well as increasing the utility rate base. This era was a win win for everyone. Consumers had abundant, low-cost power; regulators oversaw declining rates, increased electrification, and economic growth; and utilities and stockholders gained financially.

The Arab Oil Embargo of the 1970s changed that in a hurry. Rapid increases in the cost of fuel to operate power plants translated into equally large jumps in retail power prices. Continued increases in oil prices and unstable fuel supplies led electric utilities to construct new power plants that relied on domestic coal and uranium. These plants cost much more to build than simple oil or natural gas-fired generators. Consequently, the fixed costs of utility operations increased, further increasing retail electricity prices. The natural consequence was consumer complaints and increased regulatory oversight.

For a variety of reasons, including a poor economy and customer resistance to higher rates, demand declined and many utilities ended up building more power plants than needed and/or plants that were very expensive. By the early 1980s, the situation appeared to be out of control, with most utilities requesting routine, often significant, rate increases and several utilities on the verge of bankruptcy. As a result, regulators began to take a much more active role in utility planning. One response was for regulators to require utilities to evaluate conservation and other alternatives rather than automatically building new plants. This process, called integrated resource planning (IRP), was successful in keeping retail rates in check, although rates were still thought to be too high.

The 1970s and 1980s saw the launching of several trends that paved the way for electric utility deregulation. The first was the energy-efficiency efforts resulting from the oil price shocks. Rising fuel prices hit the transportation industry especially hard. In response, engine manufacturers designed more fuel efficient motors. The jet turbine engine used by the airline industry is identical to that used in peaking power plants. Consequently, power plants based on these new, aero-derivative turbines had lower production costs than older designs, significantly so. Utility demand for natural gas as a generating fuel could not be satisfied at 1970 levels of production owing to peculiarities in natural gas industry regulation. Solving this problem led to the second trend, deregulation.

Deregulation of the natural gas industry paved the way for electric industry deregulation both by unleashing market forces to free up natural gas for electricity generation and through FERC’s experience with gas industry restructuring.

Source: A Primer on Electric Utilities,

Deregulation, and Restructuring of U.S. Electricity Markets – May 2002 Gas Bill Save 10% to 70% on Your Electricity Costs

Historically, the cost of generating power declined as utilities built ever-larger power plants, which increased efficiency and reduced production costs. Utilities routinely requested rate reductions based on declining costs as well as to increase electrical demand. Increased electric demand required more and larger plants, which reduced costs further as well as increasing the utility rate base. This era was a win win for everyone. Consumers had abundant, low-cost power; regulators oversaw declining rates, increased electrification, and economic growth; and utilities and stockholders gained financially.

The Arab Oil Embargo of the 1970s changed that in a hurry. Rapid increases in the cost of fuel to operate power plants translated into equally large jumps in retail power prices. Continued increases in oil prices and unstable fuel supplies led electric utilities to construct new power plants that relied on domestic coal and uranium. These plants cost much more to build than simple oil or natural gas-fired generators. Consequently, the fixed costs of utility operations increased, further increasing retail electricity prices. The natural consequence was consumer complaints and increased regulatory oversight.

For a variety of reasons, including a poor economy and customer resistance to higher rates, demand declined and many utilities ended up building more power plants than needed and/or plants that were very expensive. By the early 1980s, the situation appeared to be out of control, with most utilities requesting routine, often significant, rate increases and several utilities on the verge of bankruptcy. As a result, regulators began to take a much more active role in utility planning. One response was for regulators to require utilities to evaluate conservation and other alternatives rather than automatically building new plants. This process, called integrated resource planning (IRP), was successful in keeping retail rates in check, although rates were still thought to be too high.

The 1970s and 1980s saw the launching of several trends that paved the way for electric utility deregulation. The first was the energy-efficiency efforts resulting from the oil price shocks. Rising fuel prices hit the transportation industry especially hard. In response, engine manufacturers designed more fuel efficient motors. The jet turbine engine used by the airline industry is identical to that used in peaking power plants. Consequently, power plants based on these new, aero-derivative turbines had lower production costs than older designs, significantly so. Utility demand for natural gas as a generating fuel could not be satisfied at 1970 levels of production owing to peculiarities in natural gas industry regulation. Solving this problem led to the second trend, deregulation.

Deregulation of the natural gas industry paved the way for electric industry deregulation both by unleashing market forces to free up natural gas for electricity generation and through FERC’s experience with gas industry restructuring.

Source: A Primer on Electric Utilities,

Deregulation, and Restructuring of U.S. Electricity Markets – May 2002

- Gas Prices

- Backbone Transportation Service (formerly FAR OFF)

- Gas Acquisition - Secondary Market Services

- Envoy

- Constrained Area Non Core Capacity Trading

- California Energy Hub

- Storage Services

- Power Generation

- Equipment & Technology

- Technology Investments

- Transfer or "Trade" Curtailment Requirements

- Liquified Natural Gas (LNG) Gas Quality

- Gas Suppliers: New or Expanded Interconnection Receipt Points for California Gas Producers, BioGas and LNG Suppliers

-

Gas Acquisition - Secondary Market Services

Park, Loan and Wheel

Advantages

- Ability to execute firm and interruptible transactions

- Access to more than 1 billion cubic feet of flowing gas supply per day

- Access to gas storage inventory

- Mitigate monthly imbalance positions

- Balance long or short positions

- Arrange delivery of gas into other delivery points or systems

Services Available

- Parking - Gas is held for set period of time and returned at the same location.

- Loaning - Gas is loaned for a set period of time and repaid at the same location.

- Wheeling - Receipt of gas at one location and delivery of gas at another location on the SoCalGas system.

Example of Park

- Market assumptions: California border gas is contango from December to the following February.

- Your Gas Acquisition - Secondary Market Services representative determines the Gas Acquisition - Secondary Market Services has assets available to park gas in December for withdrawal the following February.

- You buy December gas and deliver it to the Gas Acquisition - Secondary Market Services for a negotiated fee.

- The Gas Acquisition - Secondary Market Services delivers the gas back to you the following February.

Example of Loan

- Market assumptions: California border gas market is in backwardation from January to April of the current year.

- Your Gas Acquisition - Secondary Market Services representative determines the Gas Acquisition - Secondary Market Services has assets available to loan gas in January for an April payback.

- You borrow January gas from the Gas Acquisition - Secondary Market Services for a negotiated fee.

- You deliver the gas back in April to the Gas Acquisition - Secondary Market Services.

Example of Wheel

- A customer has California production gas in one location and a market in another location.

- The Gas Acquisition - Secondary Market Services can receive and deliver gas at different points within the SoCalGas system subject to system operations for a negotiated fee.

To ensure Gas Acquisition - Secondary Market Services Services are readily available to meet your needs, sign a Secondary Market Services Agreement. There's no cost or obligation. Individual deals will be verified through confirmations.

Call today, and we'll do the rest.

For additional information, please call:

Steve Baird (213) 244-3901

Reginald Gentry (213) 244-3815 or

Ralph Gotauco at (213) 244-3872

SoCalGas System Map

SoCalGas Pipeline map (Adobe PDF, 39 KB)

Credit Application

Credit Application (PDF, 60 KB)

-

http://www.cpuc.ca.gov/puc/energy/gas/natgasandca.htm

Natural Gas and California

The California Public Utilities Commission (PUC) regulates natural gas utility service for approximately 10.8 million customers that receive natural gas from Pacific Gas and Electric (PG&E), Southern California Gas (SoCalGas), San Diego Gas & Electric (SDG&E), Southwest Gas, and several smaller natural gas utilities. The CPUC also regulates independent storage operators Lodi Gas Storage, Wild Goose Storage, Central Valley Storage and Gill Ranch Storage.

The vast majority of California's natural gas customers are residential and small commercial customers, referred to as "core" customers, who accounted for approximately 32% of the natural gas delivered by California utilities in 2012. Large consumers, like electric generators and industrial customers, referred to as "noncore" customers, accounted for approximately 68% of the natural gas delivered by California utilities in 2012.

The PUC regulates the California utilities' natural gas rates and natural gas services, including in-state transportation over the utilities' transmission and distribution pipeline systems, storage, procurement, metering and billing.

The PUC regulates the California utilities' natural gas rates and natural gas services, including in-state transportation over the utilities' transmission and distribution pipeline systems, storage, procurement, metering and billing.

Most of the natural gas used in California comes from out-of-state natural gas basins. In 2012, California customers received 35% of their natural gas supply from basins located in the Southwest, 16% from Canada, 40% from the Rocky Mountains, and 9% from basins located within California. California gas utilities may soon also begin receiving biogas into their pipeline systems.

Natural gas from out-of-state production basins is delivered into California via the interstate natural gas pipeline system. The major interstate pipelines that deliver out-of-state natural gas to California consumers are the Gas Transmission Northwest Pipeline, Kern River Pipeline, Transwestern Pipeline, El Paso Pipeline, the Ruby Pipeline, Questar Southern Trails and Mojave Pipeline. Another pipeline, the North Baja – Baja Norte Pipeline, takes gas off the El Paso Pipeline at the California/Arizona border, and delivers that gas through California into Mexico. While the Federal Energy Regulatory Commission (FERC) regulates the transportation of natural gas on the interstate pipelines, the CPUC often participates in FERC regulatory proceedings to represent the interests of California natural gas consumers.

Most of the natural gas transported via the interstate pipelines, as well as some of the California-produced natural gas, is delivered into the PG&E and SoCalGas intrastate natural gas transmission pipeline systems (commonly referred to as California's "backbone" natural gas pipeline system). Natural gas on the utilities' backbone pipeline systems is then delivered into the local transmission and distribution pipeline systems, or to natural gas storage fields. Some large noncore customers take natural gas directly off the high-pressure backbone pipeline systems, while core customers and other noncore customers take natural gas off the utilities' distribution pipeline systems. The PUC has regulatory jurisdiction over 150,000 miles of utility-owned natural gas pipelines, which transported 82% of the total amount of natural gas delivered to California's gas consumers in 2012.

SDG&E and Southwest Gas' southern division are wholesale customers of SoCalGas, and currently receive all of their natural gas from the SoCalGas system (Southwest Gas also provides natural gas distribution service in the Lake Tahoe area). Some other municipal wholesale cusotmers are the cities of Palo Alto, Long Beach, and Vernon, which are not regulated by the CPUC.

Some of the natural gas delivered to California customers may be delivered directly to them without being transported over the regulated utility systems. For example, the Kern River/Mojave pipeline system can deliver natural gas directly to some large customers, "bypassing" the utilities' systems. Much of California-produced natural gas is also delivered directly to large consumers.

PG&E and SoCalGas own and operate several natural gas storage fields that are located in northern and southern California. These storage fields, and four independently owned storage utilities – Lodi Gas Storage, Wild Goose Storage, Central Valley Storage, and Gill Ranch Storage – help meet peak seasonal natural gas demand and allow California natural gas customers to secure natural gas supplies more efficiently. (A portion of the Gill Ranch facility is owned by PG&E).

California's regulated utilities do not own any natural gas production facilities. All of the natural gas sold by these utilities must be purchased from suppliers and/or marketers. The price of natural gas sold by suppliers and marketers was deregulated by the FERC in the mid-1980's and is determined by "market forces". However, the PUC decides whether California's utilities have taken reasonable steps in order to minimize the cost of natural gas purchased on behalf of their core customers.

Although most of California's core customers purchase natural gas directly from the regulated utilities, core customers have the option to purchase natural gas from independent, unregulated natural gas marketers. Most of California's noncore customers, on the other hand, make natural gas supply arrangements directly with producers or purchase natural gas from marketers. Contact information for independent natural gas marketers can be found on the utilities' web sites.

Prior to the late 1980's, California's regulated utilities provided virtually all natural gas services to natural gas customers. Since then, the PUC has gradually restructured the natural gas industry in order to give customers more options while assuring regulatory protections for those customers that wish to continue receiving utility-provided services. The option to purchase natural gas from independent suppliers, as noted above, is one of the results of this restructuring process.

Another option resulting from the natural gas industry's restructuring process occurred in 1993, when the PUC removed the utilities' storage service responsibility for noncore customers, along with the cost of this storage service from noncore customers' rates. In 1993, the PUC also adopted specific storage reservation levels for the utilities' core customers.

In a 1997 decision, the PUC adopted PG&E's "Gas Accord," which unbundled backbone transmission costs from noncore transportation rates, and gave customers and marketers the opportunity to obtain pipeline capacity rights on PG&E's backbone pipeline system. The Gas Accord also required PG&E to set aside a certain amount of pipeline capacity in order to deliver natural gas to its core customers. Subsequent PUC decisions modified and extended the initial terms of the Gas Accord. The "Gas Accord" framework is still in place today for PG&E's backbone and storage rates and services.

In a December 2006 decision, the PUC adopted a similar gas transmission framework for southern California, called the "firm access rights" system. SoCalGas and SDG&E implemented the firm access rights (FAR) system in October 2008. Under the FAR system, customers may obtain firm receipt point capacity rights for delivery on the integrated SoCalGas/SDG&E gas transmission system. - Understand Electricity Deregulation in California The California legislature suspended electric choice, or direct access, in 2001, after the state suffered an energy crisis. Though a few consumers retained the right to choose an electric service provider, the majority of California residents lost the ability to shop among suppliers. Now, over a decade later, can customers buy competitive energy supply in California?

Though the state's energy market is not as open as some other areas of the U.S., California has made strides to give some consumers the right to choose an electricity provider again. In 2010, Senate Bill 695 was passed to allow partial reopening of the competitive electricity market in California. The legislation, however, only applies to non-residential customers. Under the law, businesses can enroll in direct access up to an annual limit, or load cap. Over the course of four years, each utility's load capacity can increase, allowing more customers to purchase electricity from competitive electric service providers.

By the end of 2013, each utility's electric choice cap will reach 100 percent. After the program reaches its maximum participation, California residents will no longer have the option to shop for an electric service provider. Without additional legislation, the cap will not be extended to allow more consumers to switch to a retail supplier.

For Pacific Gas & Electric the cap equates to 9,520 gWh, Southern California Edison will reach 11,710 gWh and San Diego Gas & Electric caps at 3,562 gWh. Participation in the direct access program is on a first-come first-serve basis. Customers who apply but don't make the cut are put on a waitlist, a significant problem since the slots fill up in minutes.

With only a small fraction of commercial customers involved in direct access, many retail choice advocates are petitioning the California Public Utilities Commission to either increase the load caps to allow more businesses to choose an electric service provider or open up the market to everyone.

Under direct access, a customer's delivery and supply charges are separated. The utility continues to deliver the customer's power through its power lines and still handles all line maintenance and service outages. However, the customer can choose an alternate provider for electricity supply.

With electric service providers, the market is often competitive so consumers may be able to obtain a lower rate or a customized product, such as green energy. For many, just having a choice when it comes to their electricity rate is a huge incentive to switch.

Natural gas choice is limited in California

In 1995, California enacted a core aggregation transportation program that granted residential and small business consumers the right to choose a natural gas supplier. The state allows customers to purchase natural gas supply from third-party retailers, or marketers, that meet minimum aggregation levels of at least 120,000 therms each year. However, only four marketers offer natural gas supply in California. Three serve multi-family residential customers, such as apartment buildings, while only one serves single-family households.

In 1999, California passed legislation requiring local distribution companies to provide bundled service. Essentially, your utility is required to take care of the whole energy process. It is responsible for providing your natural gas supply, delivering the commodity and maintaining the infrastructure required to transport gas to your home.

However, the law exempted core aggregation programs, allowing consumers who meet the program's qualifications to shop for natural gas. Customers who select a marketer instead of the utility for natural gas supply must sign a one-year agreement.

A very small fraction of people in the state actually switch to a retail marketer. Most residents continue to pay utility rates for natural gas supply. In fact, about 95 percent of the state is served by San Diego Gas and Electric, Southern California Gas and Pacific Gas & Electric.

If you are interested in becoming one of the few who get the opportunity to select an alternative natural gas supplier, you need to verify that you're eligible to participate in the exemption from the 1999 law. If you use at least 120,000 therms of natural gas each year and live in one of the areas served by retail marketers, you should be able to switch to a natural gas supplier today.

A few states have implemented natural gas choice and have seen a robust competitive energy market emerge. Part of the reason the option can be successful is because sometimes it's possible to find a lower rate with a retail natural gas supplier.

For those who participate in natural gas choice, the process of getting energy is slightly different than usual. Instead of the utility handling the entire process, it is split into two parts: supply and delivery. A marketer will purchase a wholesale supply of natural gas and sell it directly to consumers. Then the consumer's supply will go through the utility, which will transport the commodity to the appropriate home. The utility owns the pipes for the delivery process and is in charge of making repairs and fixing any issues related to the infrastructure.

What is Deregulation?

Why Deregulation? A Historical Perspective

Historically, the cost of generating power declined as utilities built ever-larger power plants, which increased efficiency and reduced production costs. Utilities routinely requested rate reductions based on declining costs as well as to increase electrical demand. Increased electric demand required more and larger plants, which reduced costs further as well as increasing the utility rate base. This era was a win win for everyone. Consumers had abundant, low-cost power; regulators oversaw declining rates, increased electrification, and economic growth; and utilities and stockholders gained financially.

The Arab Oil Embargo of the 1970s changed that in a hurry. Rapid increases in the cost of fuel to operate power plants translated into equally large jumps in retail power prices. Continued increases in oil prices and unstable fuel supplies led electric utilities to construct new power plants that relied on domestic coal and uranium. These plants cost much more to build than simple oil or natural gas-fired generators. Consequently, the fixed costs of utility operations increased, further increasing retail electricity prices. The natural consequence was consumer complaints and increased regulatory oversight.

For a variety of reasons, including a poor economy and customer resistance to higher rates, demand declined and many utilities ended up building more power plants than needed and/or plants that were very expensive. By the early 1980s, the situation appeared to be out of control, with most utilities requesting routine, often significant, rate increases and several utilities on the verge of bankruptcy. As a result, regulators began to take a much more active role in utility planning. One response was for regulators to require utilities to evaluate conservation and other alternatives rather than automatically building new plants. This process, called integrated resource planning (IRP), was successful in keeping retail rates in check, although rates were still thought to be too high.

The 1970s and 1980s saw the launching of several trends that paved the way for electric utility deregulation. The first was the energy-efficiency efforts resulting from the oil price shocks. Rising fuel prices hit the transportation industry especially hard. In response, engine manufacturers designed more fuel efficient motors. The jet turbine engine used by the airline industry is identical to that used in peaking power plants. Consequently, power plants based on these new, aero-derivative turbines had lower production costs than older designs, significantly so. Utility demand for natural gas as a generating fuel could not be satisfied at 1970 levels of production owing to peculiarities in natural gas industry regulation. Solving this problem led to the second trend, deregulation.

Deregulation of the natural gas industry paved the way for electric industry deregulation both by unleashing market forces to free up natural gas for electricity generation and through FERC’s experience with gas industry restructuring.

Source: A Primer on Electric Utilities,

Deregulation, and Restructuring of U.S. Electricity Markets – May 2002 Gas Bill Save 10% to 70% on Your Electricity Costs

What is Deregulation?

Why Deregulation? A Historical Perspective

Historically, the cost of generating power declined as utilities built ever-larger power plants, which increased efficiency and reduced production costs. Utilities routinely requested rate reductions based on declining costs as well as to increase electrical demand. Increased electric demand required more and larger plants, which reduced costs further as well as increasing the utility rate base. This era was a win win for everyone. Consumers had abundant, low-cost power; regulators oversaw declining rates, increased electrification, and economic growth; and utilities and stockholders gained financially.

The Arab Oil Embargo of the 1970s changed that in a hurry. Rapid increases in the cost of fuel to operate power plants translated into equally large jumps in retail power prices. Continued increases in oil prices and unstable fuel supplies led electric utilities to construct new power plants that relied on domestic coal and uranium. These plants cost much more to build than simple oil or natural gas-fired generators. Consequently, the fixed costs of utility operations increased, further increasing retail electricity prices. The natural consequence was consumer complaints and increased regulatory oversight.

For a variety of reasons, including a poor economy and customer resistance to higher rates, demand declined and many utilities ended up building more power plants than needed and/or plants that were very expensive. By the early 1980s, the situation appeared to be out of control, with most utilities requesting routine, often significant, rate increases and several utilities on the verge of bankruptcy. As a result, regulators began to take a much more active role in utility planning. One response was for regulators to require utilities to evaluate conservation and other alternatives rather than automatically building new plants. This process, called integrated resource planning (IRP), was successful in keeping retail rates in check, although rates were still thought to be too high.

The 1970s and 1980s saw the launching of several trends that paved the way for electric utility deregulation. The first was the energy-efficiency efforts resulting from the oil price shocks. Rising fuel prices hit the transportation industry especially hard. In response, engine manufacturers designed more fuel efficient motors. The jet turbine engine used by the airline industry is identical to that used in peaking power plants. Consequently, power plants based on these new, aero-derivative turbines had lower production costs than older designs, significantly so. Utility demand for natural gas as a generating fuel could not be satisfied at 1970 levels of production owing to peculiarities in natural gas industry regulation. Solving this problem led to the second trend, deregulation.

Deregulation of the natural gas industry paved the way for electric industry deregulation both by unleashing market forces to free up natural gas for electricity generation and through FERC’s experience with gas industry restructuring.

Source: A Primer on Electric Utilities,

Deregulation, and Restructuring of U.S. Electricity Markets – May 2002